1. Types of Swiss residence permit

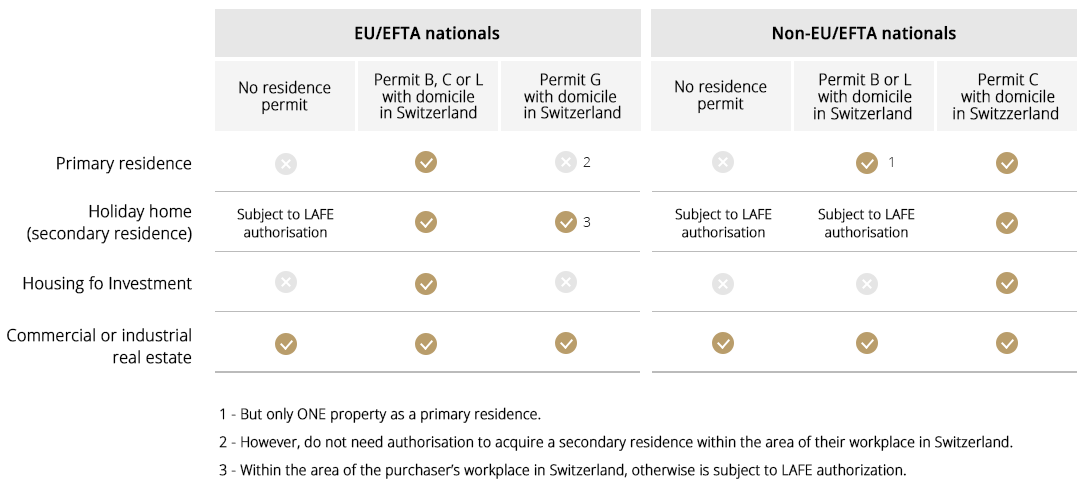

Permit B (temporary residence permit) – residence permit for a one-year stay in Switzerland, which can be renewed (EU/EFTA nationals: valid 5 years). With this permit you can buy residential real estate for your primary place of residence.

Permit C (settlement residence permit) – permit granting full residence rights in Switzerland, which is obtained after 5 or 10 years, depending on one's nationality. With this permit you can change employers and jobs as you wish, become self-employed, live anywhere you like in Switzerland and buy as many properties as you wish.

Permit L (short-term residence permit) – valid for up to one year, which can be renewed but only up to 24 months in total. It is usually linked to a specific job/company, and you do not automatically get a new permit if you change jobs. EU/ EFTA nationals with L permit and their domicile in Switzerland can buy a secondary residence.

Permit G (cross-border commuter permit) - this permit is for people who work in Switzerland but live in the territory of an EU/EFTA member state. Cross-border commuters return to their main place of residence abroad at least once a week. The G permit is valid for 5 years as long as there is an employment contract of one year or more.

Other residence permits: Permit Ci (for relatives of workers of inter-governmental organisations/foreign embassies); F (for provisionally admitted foreigners – people who have been ordered back to their home country but cannot leave Switzerland for some reason); N (permit for asylum seekers); and S (person in need of protection).